Credit card processing agents play a crucial role in the landscape of modern commerce. They facilitate transactions between merchants and consumers, ensuring that payment processes are smooth, secure, and efficient. Understanding their function not only helps businesses make informed decisions but also sheds light on the intricacies of electronic payment systems.

In an era where online shopping and digital payments dominate, having a reliable credit card processing agent can significantly impact a business’s success. These agents manage everything from transaction authorization to fund settlement, making them indispensable partners for retailers of all sizes. With the right agent, businesses can enhance customer satisfaction while minimizing fraud risks.

As the demand for seamless payment solutions grows, it becomes essential to explore the various aspects of credit card processing agents. Readers will discover how to choose the right agent, the technology involved, and the benefits of establishing a strong partnership in this evolving market.

Understanding Credit Card Processing

Credit card processing involves a series of actions that enable businesses to accept credit card payments from customers. The key components include the roles of agents, the lifecycle of transactions, and the various processing solutions available.

The Role of a Credit Card Processing Agent

A credit card processing agent acts as an intermediary between merchants and financial institutions. Their primary function is to facilitate transactions securely and efficiently.

They help businesses set up merchant accounts, ensuring compliance with industry regulations. Agents also provide ongoing support, including assistance with payment technology and troubleshooting issues.

Additionally, they educate merchants about fees and chargebacks. By understanding the terms and conditions, businesses can make informed decisions about the services they utilize.

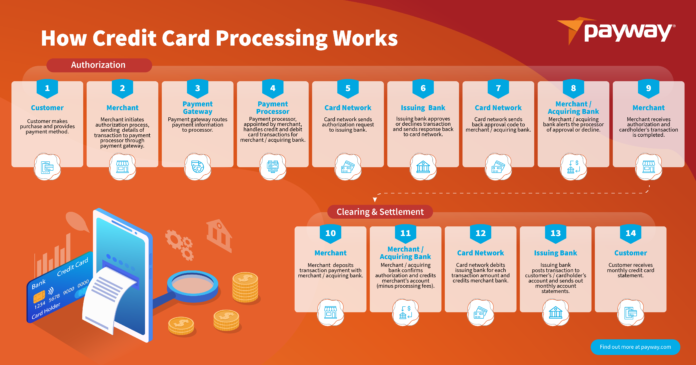

Transaction Lifecycle

The transaction lifecycle consists of several stages, ensuring funds are transferred securely from consumer to merchant.

- Authorization: When a customer swipes their card, the transaction is authorized via a payment gateway. The bank checks the account to ensure sufficient funds.

- Capture: Once authorized, the transaction is captured. The merchant submits the authorization along with transaction details.

- Settlement: The funds are then transferred to the merchant’s bank, usually within a few days. This stage involves processing all transactions from the day.

- Funding: Finally, the bank funds the merchant’s account, completing the process.

Understanding each stage helps merchants maintain efficient operations.

Types of Credit Card Processing Solutions

Various payment processing solutions exist to meet different business needs. This includes:

- Point of Sale (POS) Systems: Ideal for brick-and-mortar businesses, these systems manage in-person transactions.

- Mobile Payment Solutions: These allow businesses to accept payments via smartphones or tablets, catering to on-the-go transactions.

- E-commerce Solutions: Online businesses rely on secure payment gateways to process credit card payments seamlessly.

- Virtual Terminals: Useful for businesses taking orders over the phone, allowing manual entry of card details.

Selecting the right solution depends on a business’s specific needs, transaction volume, and customer preferences.

Becoming a Successful Processing Agent

Success as a credit card processing agent hinges on a combination of essential skills, industry knowledge, and effective client management. Mastering these areas can create opportunities for growth and build a reputable business.

Essential Skills and Traits

To thrive as a processing agent, one must possess strong analytical abilities. This skill helps in assessing merchant needs and recommending tailored solutions.

Excellent communication is also vital. An agent must articulate complex concepts clearly to clients.

Key traits include:

- Integrity: Trustworthiness fosters long-lasting client relationships.

- Adaptability: The payments industry evolves quickly; staying flexible is key.

- Problem-solving: Agents should identify and resolve issues efficiently.

These capabilities lead to successful interactions with clients and partners.

Industry Training and Certification

Formal education is beneficial but not mandatory. Many successful agents gain knowledge through industry-specific training programs.

Certifications from reputable organizations, such as:

- National Association of Payment Professionals (NAPP)

- Payment Card Industry Data Security Standards (PCI DSS)

These certifications validate expertise and enhance credibility.

Ongoing education is essential in this ever-changing field. Agents should keep abreast of the latest technologies and regulatory updates to maintain a competitive edge.

Building a Clientele

Establishing a robust client base is crucial for long-term success. Networking plays a significant role in gaining referrals.

Effective strategies include:

- Utilizing social media: Platforms like LinkedIn can help connect with potential clients.

- Participating in trade shows: Showcasing services at industry events raises visibility.

- Offering personalized service: Understanding individual client needs fosters loyalty.

Regular follow-ups and maintaining contact can also reinforce relationships, leading to repeat business and referrals.